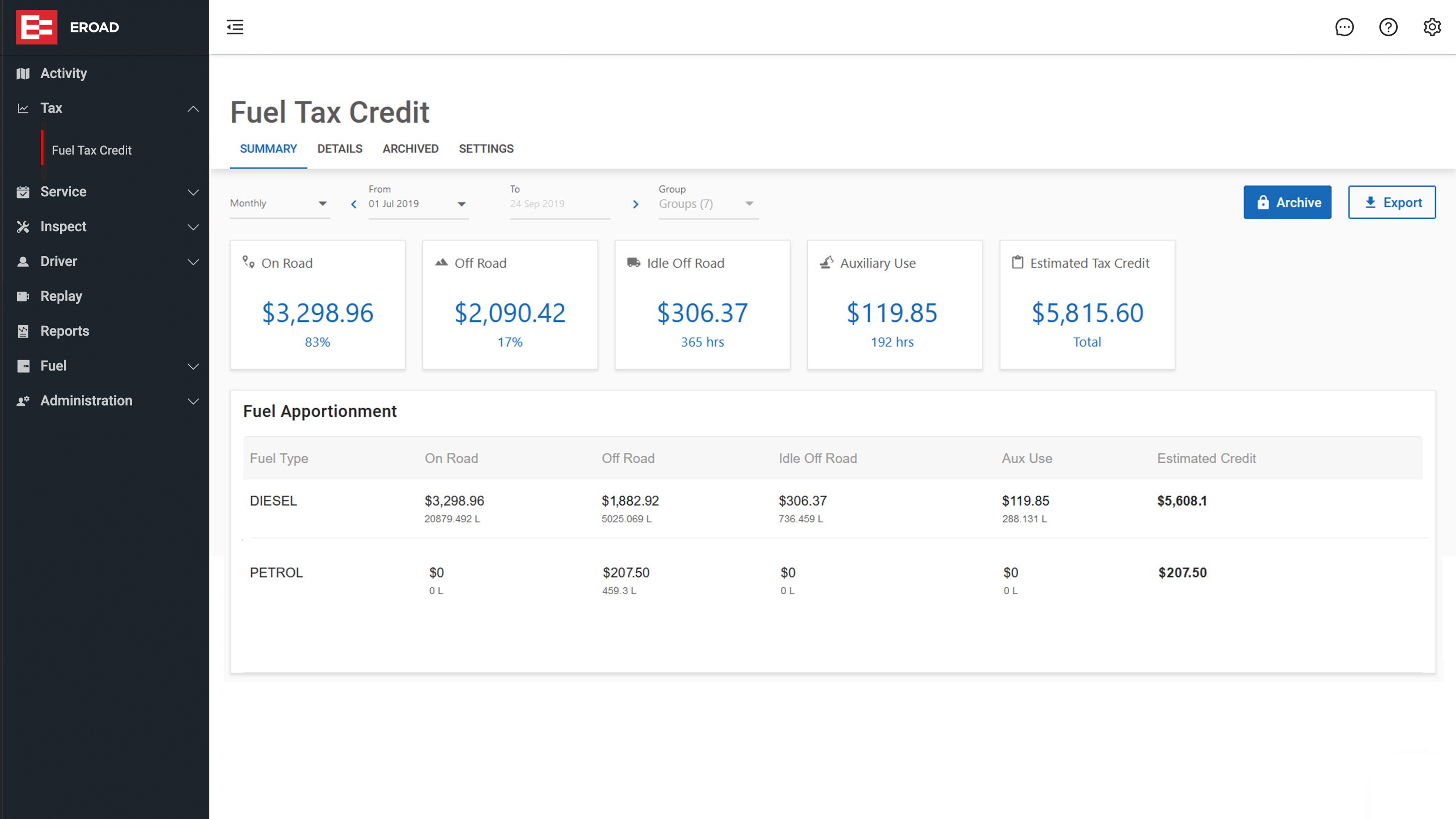

Fuel Tax Credit Solution

Our Fuel Tax Credits module automates data collection for rebate submission, improving accuracy, forecasting and claim frequency

Fuel Tax Credits (FTC) are issued for any off-road (and some on-road) business-related driving. Fuel tax credits rates vary based on usage – for example, fuel used for auxiliary equipment (e.g. refrigeration, cement mixer), should be claimed at a higher rate. Without accurate measurement, accountants have to rely on manual records and safe-harbour provisions from the ATO. This method requires using complex spreadsheets, which can underestimate the rebate owed. Given the complexity and specialised knowledge required, companies without accurate data tend to under-claim.

With EROAD, it is possible to accurately collect and automate the process to help maximise and streamline your FTC claims.

This is particularly useful for fleets that:

Often use vehicles off-road or on non-public roads (e.g. construction sites, quarries, farms, distribution centres)

Operate heavy vehicles with auxiliary fuel usage (e.g refrigerators, cement mixers or garbage compactors)

Perform public works, where the site can be geo-fenced to increase the accuracy of FTC claims

If you can demonstrate a six-month pattern of consistent use, you can go back up to four-years to recover under-claimed rebates.

How it works

Track movement accurately esp. off-public road usage

Accurately record auxiliary and idle time fuel usage to claim at the higher rate

Geo fencing your sites ensures you claim accurate for all off-road usage

Key benefits

Automatically generate claim reports

Claim up to 2.5 times more for off-road than on-road

Use high resolution GPS & our monthly updated maps to make accurate claims

Efficient claims

Accurate claims, maximising on AUX, Idle and off-road usage

The system uses the right rate for each time period

We find that most organisations do not claim for Auxiliary fuel usage

The estimates for off-road usage from basic dot-on-the map GPS solutions err on the side of caution and tend to under-estimate usage

Take a quick 2 month trial of our FTC solution to see how much more tax credits you can claim with more accurate data.

We have experience helping key industries

“The most exciting outcome from using the EROAD Fuel Tax Credit solution was the recovery of under claimed rebates, it was a great bonus to receive, $1310.00 AUD per vehicle in fuel tax credit rebates.”

Zoe Moulton, Co-director, Pingelly Transport