Making FTC easy for the mining and gas industry

Making FTC easy for the mining and gas industry

The mining and gas industry demands a lot of heavy lifting when it comes to the use of vehicles and machinery to carry out its day-to-day activities. Fuel used in vehicles (both heavy and light) and in machinery and equipment on oil and gas fields, which are classified as off-road, can be claimed back at the highest FTC rate.

The ATO classifies fuel used for the following activities as claimable for FTC:

- exploring and prospecting for minerals

- removing overburden or preparing a site for mining

- recovering minerals

- beneficiation of minerals or ores – for example, production of bauxite into alumina

- rehabilitation of a place affected by a mining operation

- removing mining waste from a mine site.

The following activities may also be eligible if they occur at a place where a mining operation is carried out:

- searching for ground water solely for use in a mining operation

- pumping or supply of water solely for use in a mining operation – this activity may also be eligible if the water is sourced from a place adjacent to the place where the mining operation occurs

- certain construction activities – for example, constructing private access roads, buildings, tailing dams and other dams for use in a mining activity

- disposal of waste from a mining activity

- servicing, maintenance or repair of vehicles, plant and equipment you use in a mining transport operation

- servicing, maintenance or repair of a transport network you use solely in a mining transport operation

- using a vehicle with a GVM of 4.5 tonnes or less providing the vehicle has been extensively modified for use underground and is used underground

See the ATO website for more specific details on mining activities and definitions

Let EROAD get you on the road to maximising your FTC claim

Get the FTC rebate you deserve!

Calculating your FTC manually can be a long and arduous task that often relies on estimates or averages.

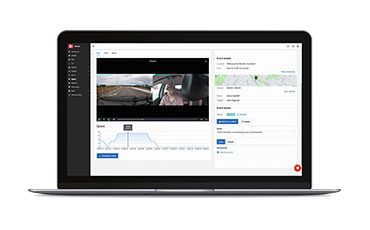

But with EROAD’s Fuel Tax Credit Solution, you can seamlessly calculate the maximum FTC rebate you’re entitled to at the touch of a button using real-time GPS data.

EROAD’s Fuel Tax Credit Solution can help your business maximise your FTC claims by:

- Accurately capturing real-time on-road and off-road travel, idle and auxiliary equipment usage

- Providing better visibility and tracking of your fleet’s fuel usage

- Providing sophisticated GPS tracking to capture vital journey and activity data which is then feed directly into simple reports to accurately calculate your FTC entitlement

- Providing the ability to use geofencing to clearly define off-road areas

- Eliminating the admin time, paperwork and guesswork by calculating your FTC claims automatically for you

- Ensuring your business is more efficient by providing a range of other monitoring and reports to enhance efficiency, productivity and safety